Does Regenerative Agricultural Need a New Finance System? / Thought Leader Spotlight on Larissa Zimberoff

The No Need for a New Finance System (38th) Edition of the Negative Foods Newsletter

[This week is the first edition of the newsletter with the feature Thought Leader Spotlight. Scroll down to hear from thought leader Larissa Zimberoff]

I long ago attended a talk at Stone Barns by Woody Tasch, who had just published Inquiries into the Nature of Slow Money: Investing as if Food, Farms, and Fertility Mattered. I agreed with Tasch’s arguments in favor of a decentralized food system that prioritized soil, the environment, the local economy and farmers. But I didn’t share his belief that we needed a new money system to get there. Seeking a friendly debate, I raised my hand and began a question by acknowledging that I was a capitalist. Tasch got an audience laugh by cutting short my question and stating that it was obvious by my looks that I was a capitalist. Sometime you can judge a book by its cover?

Ten years later, I still think Tasch was right about the U.S. food system, which is a fundamental problem that needs fixing. And I still don’t think we need to redesign our finance system to fix the food system. The logic does not flow that, because we need to replace our food system, we need to replace our finance system.

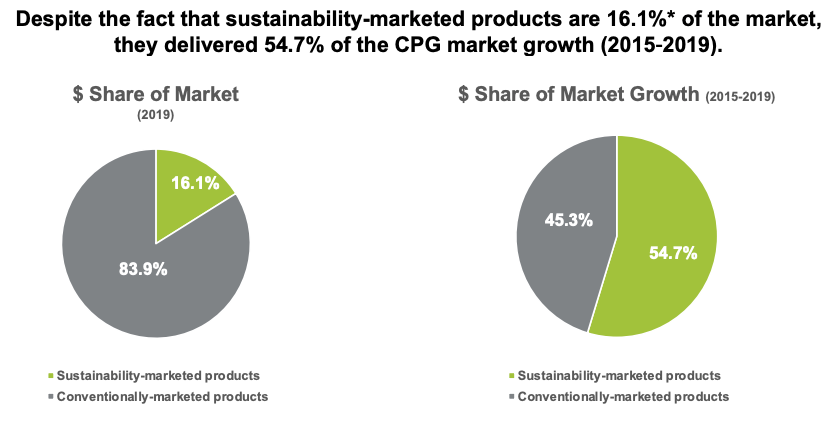

Capital will flow where it is needed and where it can work effectively. Consumer demand for food that’s better for the environment is strong and growing stronger. We have known for years that consumers in the U.S. will pay more for food they perceive to be better for the environment and their health. The 2021 Report of the NYU Stern Center for Sustainable Business makes clear that consumers want more products that are better for the environment, and are willing to pay more for such products.

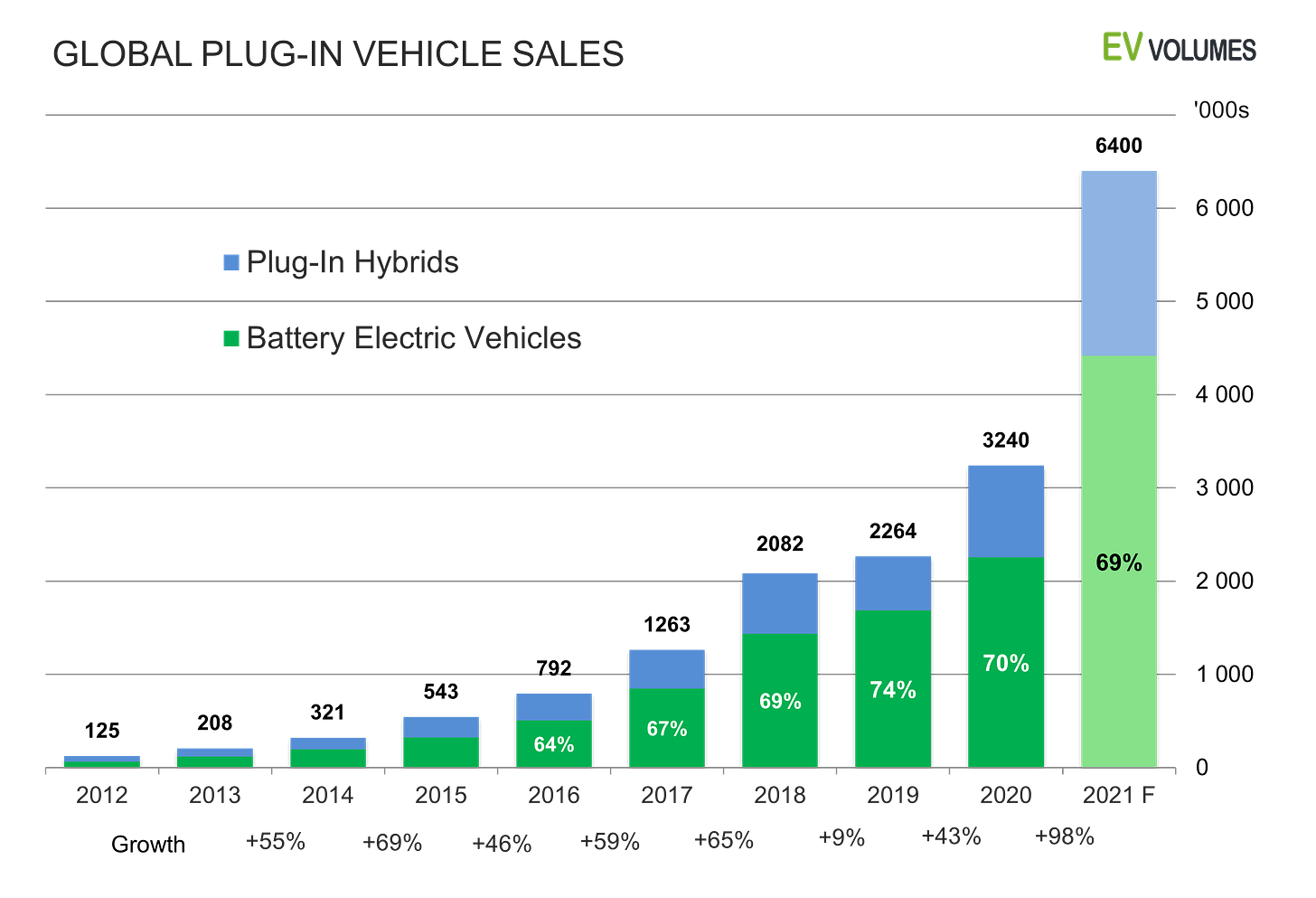

One great aspect of the food revolution is that food brands with regenerative supply chains don’t need to convince consumers to try new products, they just need to get consumers to switch to new versions of the same products they already enjoy, but with better environmental footprints. Getting people to switch from cars to busses is hard, but switching from gasoline to electric vehicles is growing like a hockey stick.

This was the experience we enjoyed in the salad category while building BrightFarms. Other examples include Hickory Nut Gap replacing industrial beef with beef raised regeneratively, and Vital Farms and Cooks Venture with eggs and chickens. These are upstarts taking market share from incumbents by bringing to market products that match rising consumer demand for improved environmental footprints. For these companies, and many others, the capital markets are working well.

Capital is flowing to meet the rise in regenerative agriculture across the country and in many different forms.

It was harder ten years ago, but even then, in the aftermath of the Great Recession, companies like BrightFarms and Revolution Foods were able to raise venture capital for building disruptive food startups. Today there is much more venture capital available for disruptive food companies, much of it directly targeting regenerative agriculture business. Check out, for example, Trailhead Capital, The Yield Lab, Regen Ventures, Provenance Capital, Acre Venture Partners, Manna Tree, Tenacious Ventures and many more.

In the early days at BrightFarms, insurance giant Prudential provided project finance for building out our greenhouse farms. Today Generate Capital and others seek to deploy project finance into large scale agriculture businesses with improved carbon footprints.

I’ve heard many times that the 10-year window for venture and private equity firms to deploy and harvest capital wasn’t sufficiently patient for regenerative agriculture companies. I was never convinced. But even that call has been answered. Blue chip investors like Sequoia capital are explicitly raising funds that eschew the ten year structure.

I could go on. CDFIs such as RSF and TRF make loans to regenerative farming business. Iroquois Valley Farmland, RePlant and Farmland LP make investments to convert farms and farmland to regenerative practices. Events and organizations have emerged to organize funders interested in supporting the transition to a regenerative food system.

Maybe Tasch was right after all? Maybe the finance system has changed, in part because of his work. Or maybe the consumer markets and entrepreneurs have evolved, and capital is flowing to the emerging better opportunities. Either way, I’m thrilled that there is more capital available to finance the future of food than I could have imagined ten years ago.

This doesn’t mean everyone and everything will get financed. Funders must adhere to investment criteria and mandates. But good businesses creating good products for consumers that increasingly want regenerative food are absolutely fundable, and the next few years will be an exciting time for the growth of Negative Foods.

Thought Leader Spotlight: Larissa Zimberoff:

Larissa Zimberoff is a journalist and author. Her book, Technically Food: Inside Silicon Valley's Mission to Change What We Eat, is available wherever books are sold. Subscribe to her newsletter and follow her at @lzimberoff and @Technically.Food.

What are the top three changes eaters can make to reduce carbon emissions?

Carbon emissions in food primarily come from energy and transportation. So, the question is, how can we eat foods that need less of these things?

Eat fresh and local. The simplest way to do this is to shop at your closest farmer’s market. This is old news, but it’s still the best way to eat for the planet—with it you support farmers in your region, they make more money because you cut out many of the usual middleman in our supply chain, and there’s no packaging to toss. If you shop at a supermarket, stick to the outside aisles.

Don’t eat frozen. If it’s frozen, and comes from far away, then you’ve upped your carbon footprint. This includes energy needed for manufacturing, plus the long and winding cold chain to keep the food frozen, which includes refrigerated trucks to deliver the goods so that you can buy them.

Turn off your ice maker. It’s a small tip, but your ice maker accounts for 20-25% of the energy needed to run your refrigerator. Once your ice bin is full, there’s no need to keep the ice maker running.

Other tips: reduce your reliance on foods that come in plastic packaging and eat red meat less often.

When it comes to foods that sequester carbon:

When people ask me about eating meat, I tell them to spend the most money they can on the very best meat. Buy from regenerative ranchers like Stemple Creek Ranch and Richards Grassfed Beef. These are just two examples but invest the time to learn more about who is producing your food, what their farm practices are, and pay them more!

What are the hottest products?

I think cover crops are super hot. Here’s a sprouted buckwheat from Lil Bucks that’s delicious and nutritious. Buckwheat gives farmers a rotation crop that generates revenue and improves the land. Lil Bucks sources its buckwheat from farms in Minnesota and North Dakota. I love the spicy, vegan popcorn from Husk. And, rather than big fish, go for Patagonia’s line of tinned fish.

What’s your favorite story from 2021?

In April, I wrote a story for Bloomberg about the increased attention regenerative organic was getting from both producers, and consumers who were willing to spend more money to support the climate. Sometimes I’m accused of being too earnest, but I really like seeing stories out there about companies willing to spend more to do things right.

What are your predictions for 2022?

Climate stress is going to motivate much of what we talk about in 2022, and this commitment will grow to truly move the needle on what we eat. I think attention will continue to grow around food waste, and the apps that are creatively addressing it including To Good To Go, FoodForAll, Olio and FlashFood to name a few.

The conversation around plant-based meat alternatives will continue to evolve. We’ll dig into the health metrics in some of these ultra-processed foods, and pay closer attention to their climate promises. We’ll see many more options and styles that will speak to every end use we can imagine.

What food innovations/tech have the most promise for leading us to a carbon-negative food system?

For me, it’s Mycelium, which is a fungus that can be easily grown for its protein. You may already have tried it in a chicken nugget from the brand Quorn. There are several brands working on this front including Atlast, Meati, and Better Meat Co. I hope we’ll start seeing these foods make their way into our supermarkets, and becoming a new center-of-plate option much like tofu or tempeh.

For Your Consideration:

Happy Family Organics for regenerative supporting farms

To a Regenerative 2022: Scaling Regenerative Grazing

The Field Report: Biden Targets Consolidation in Agriculture (Again)

Food for thought: Danone's sustainability guru leads charge

Off-season 'cover' crops expand as U.S. growers eye low-carbon future

Forget Veganuary. Let’s talk about Regenuary and the power of regenerative farming

How regenerative farmers are rewilding their land

Soup-To-Nuts Podcast: 4 ways to tap into the full potential of regenerative agriculture’s benefits

The views in this newsletter belong solely to Paul Lightfoot (and not to BrightFarms or other organizations). This newsletter accepts no advertising. Learn more about this newsletter at https://paullightfoot.substack.com/about.

Hmmm, this narrative is purely coming from an insular upper income perspective. As one of the few Black Americans to break the platinum-ceiling in the produce industry years back, whenever I hear how Americans are shifting in food habits, I always question which Americans are they talking about? Comments noted in the article about how all-Americans are wholeheartedly buying more regenerative/sustainable Ag. is plainly untrue. Move down the economic ladder, where most Americans exists, fast food, ultra-processed lower price foods continue to produce exponential profits for giant food conglomerates, primarily based on affordability and flavor profiles. Likewise, to state that investment funds are increasing in equitable dispersal in the industry, this too, is untrue. Capital, in capitalism, moves from one group with the means and transfers it to other similar groups. Therefore, the majority of capital is controlled by European male Americans, the vast majority of investments go to European male entrepreneurial ventures. Miniscule amounts drizzle down to non-European American food ventures. Overall, the regenerative/sustainable/climate smart Ag./food sector operates in a silo unaware of what the vast majority of the world is facing. Fortunately, historically marginalized food producers are finding alternative means to disrupt and succeed in biased food systems. Then, and only then will there truly be a transformative regenerative food systems crosscutting the American landscape.

Hey Paul, Are there places where individuals can invest in regenerative farming solutions? I am looking for alternative investments and have been looking at Acretrader as one option, but they aren't really focused on sustainable agriculture.